Knowledge is Money

Stay informed about getting the most out of your 401K before you rollover to an IRA.

We can help!

Keep More of Your Hard Earned Money

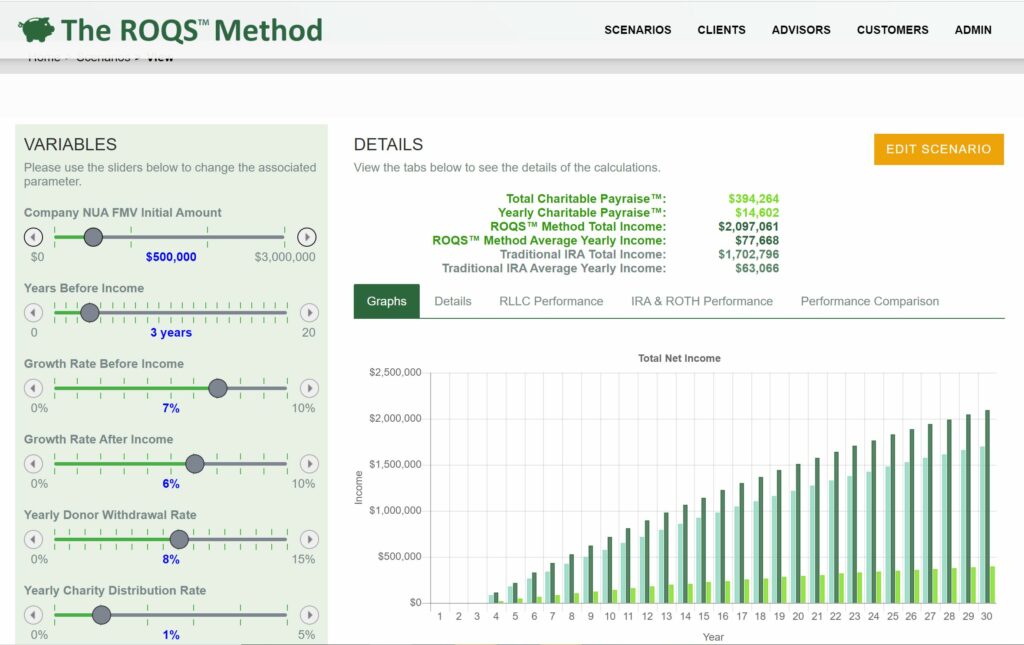

New times require new solutions. For future and current retirees who have company stock in their retirement plans, new systems and methods must be found to help retirees close the ‘gap’ between their cost of living requirements and the cash flow generated from their retirement resources.

CE Course for CPAs

The Charitable Payraise® is a new financial method designed to help those converting appreciated assets to income-producing resources in a more tax-efficient manner. The result produces substantially increased after-tax client cash flow while supporting the charity(s) of their choice. The course will identify the changes in tax law that facilitated the new method, elements of the ‘Should’ tax opinion in support of TCP, and the types of assets that do and do not qualify for use. In addition, the roles and responsibilities of the CPA, as well as other professionals, to implement and maintain the method will be addressed.

All of us at The Charitable Payraise® look forward to working with you, your advisor, and your favorite charities to optimize your retirement while making the world a better place